Sole Proprietorship firm Complete Guidance -Proprietorship Firm Registration Process and Eligibility

The sole proprietorship is one of the most common forms of business in India due to its simplicity, ease of setup, and nominal cost. It is also known as individual entrepreneurship or sole trader. Finances such as [loan, loan, profit] are under the control of the owner. Local grocery, IT consulting services, doctors, chemists are all examples of a sole proprietorship.

The entrepreneur owns all the assets of the business and the sole proprietor gets some registration to make his business go smoothly. Registering as an SME, Shop Act license, VAT, and GST registration can be obtained in the name of the proprietor. Thus, all registrations relating to proprietorships shall be in the name of proprietors, making it personally liable for all liabilities of proprietorships. Supply of goods and services to others is a sole proprietorship. This type of business is quite common in India. There is no separate legal entity involved.

However, after the startup phase, proprietorship does not offer promoters a host of benefits such as limited liability proprietorship, corporate status, separate legal entity, independent existence, transferability, permanent existence which are mandatory features for all types of business. Therefore, proprietorship registration is highly favorable for unorganized and small businesses that will remain small and have a limited period of existence.

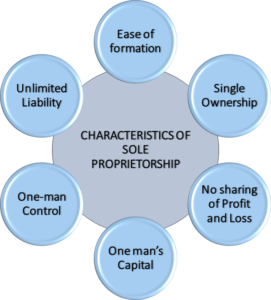

Features:

Simple and independent - Sole proprietorship is the simplest form of business, as it does not require any special registration. If necessary, a business can use its identity proof to obtain a trademark for identification.

The only king of profits- In a one-person company, the owner himself becomes the king of all profits, while in LLP, profit is shared between two or more individuals.

Sole control over the decision

All decisions are taken by proprietorship without interference. They do not need to depend on others. All adjustments are made by the proprietorship regarding the hiring of employees and determining their salaries.

Easy Formation:

There are no government fees or taxes to be paid while LLPs or other types of business organizations are required to fill certain state government forms and submit fees. This is often a lower startup cost than another form of business. Therefore, it is easy to make.

Tax Benefits:

Proprietorship offers many tax benefits such as health insurance, reduction of self-employment taxes. The only form required to file is the schedule with the IRS for tax returns.

Documents required for proprietorship registration

Proprietorship Registration FAQ

Identity and address proof

Proof of identity and address of ownership will be required. In case of Indian citizens, PAN is mandatory. For foreign nationals, it is mandatory to produce a notarized copy of the passport. A valid residence proof document such as a bank statement or electricity bill (less than 2 months old) or a person's Aadhaar card.

Registered office proof

All proprietors must have a registered office in India. In the case of a rent office, utility bill, rental agreement or sale deed and a letter from the owner of the property for ownership, to use the office, a registered office of ownership is required.

Proprietorship firm registration

Proprietorship firm registration means a firm that is owned and controlled by a sole member. There is no separate legal entity between a sole proprietor and business property. The sole member is the sole owner of the property who enjoys all the profits and suffers from all the losses of the firm. The sole member's liability is unlimited which means that when the profit of the business is not sufficient to determine the loss of the business then the sole property of the sole owner must be used to establish the loss. In proprietorship firm registration, regulatory compliance is the minimum requirement for starting and operating.

A sole member may also delegate his or her authority as an employee to another person, but shall not delegate to any other person the signing authority on the firm's legal documents.

If the sales turnover of proprietorship firm is Rs. More than. 1 crore (in case of a business) or if the gross receipt of ownership exceeds Rs. 50 lakh (in case of the profession) then tax audit is compulsory.

Features of proprietorship firm:

A person is needed as a solo entrepreneur.

The sole owner of the business.

Easy to start and easy to close.

full control.

The nominal cost of formation and compliance.

advantage and disadvantage:

Benefit

The proprietorship is easy to setup.

There is no legal entity between a sole proprietorship and business property.

There is no distribution of profit and loss.

Freedom to decide.

Less capital is required.

Loss

There is unlimited liability.

It is difficult to increase investment.

To establish proprietorship firm registration